OnePact Feasibility

Onepact Feasibility

Navigating the complexities of battery investment can be challenging, but Onepact Feasibility simplifies the process. By leveraging AI, it offers smart investment analysis, automated cash flow projections, and optimal technology selection to ensure your decisions are both informed and effective.

In other words, your path to feasible energy investment starts here.

OUR APPROACH TO KEY CHALLENGES

Operational Challenges: Resolved

CHALLENGE

SOLUTION

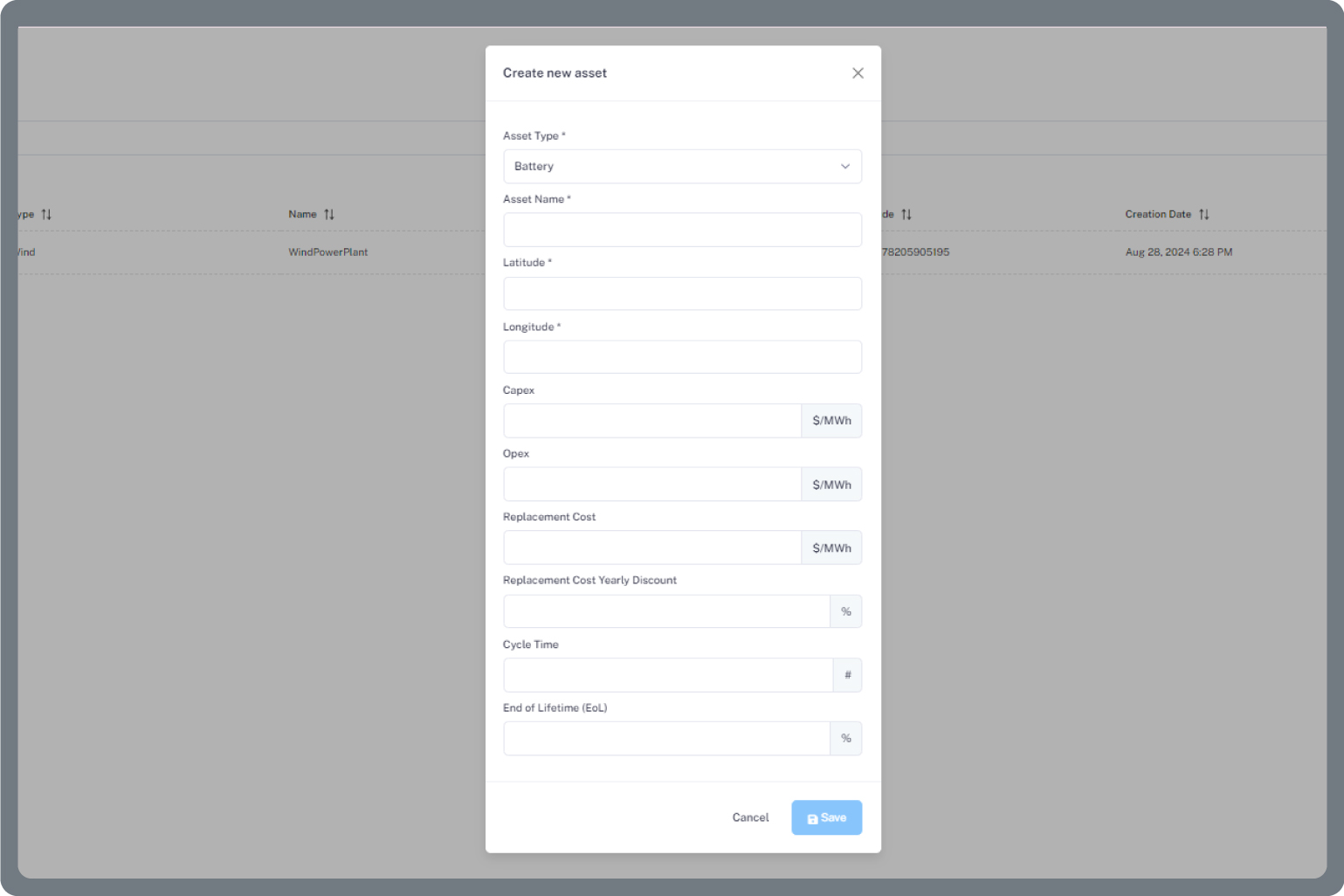

Determining the most feasible battery investment is challenging, leading to potential decision-making issues.

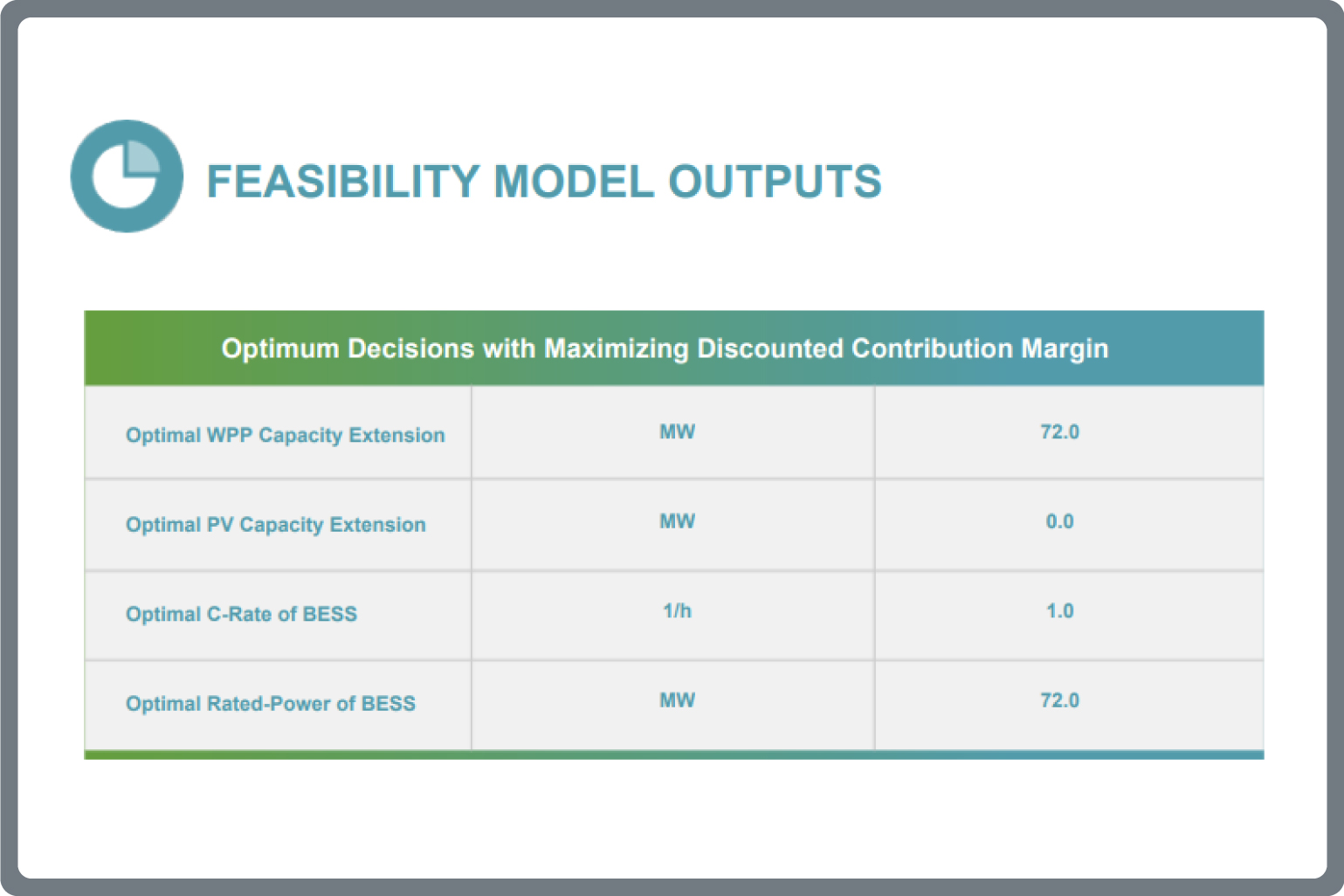

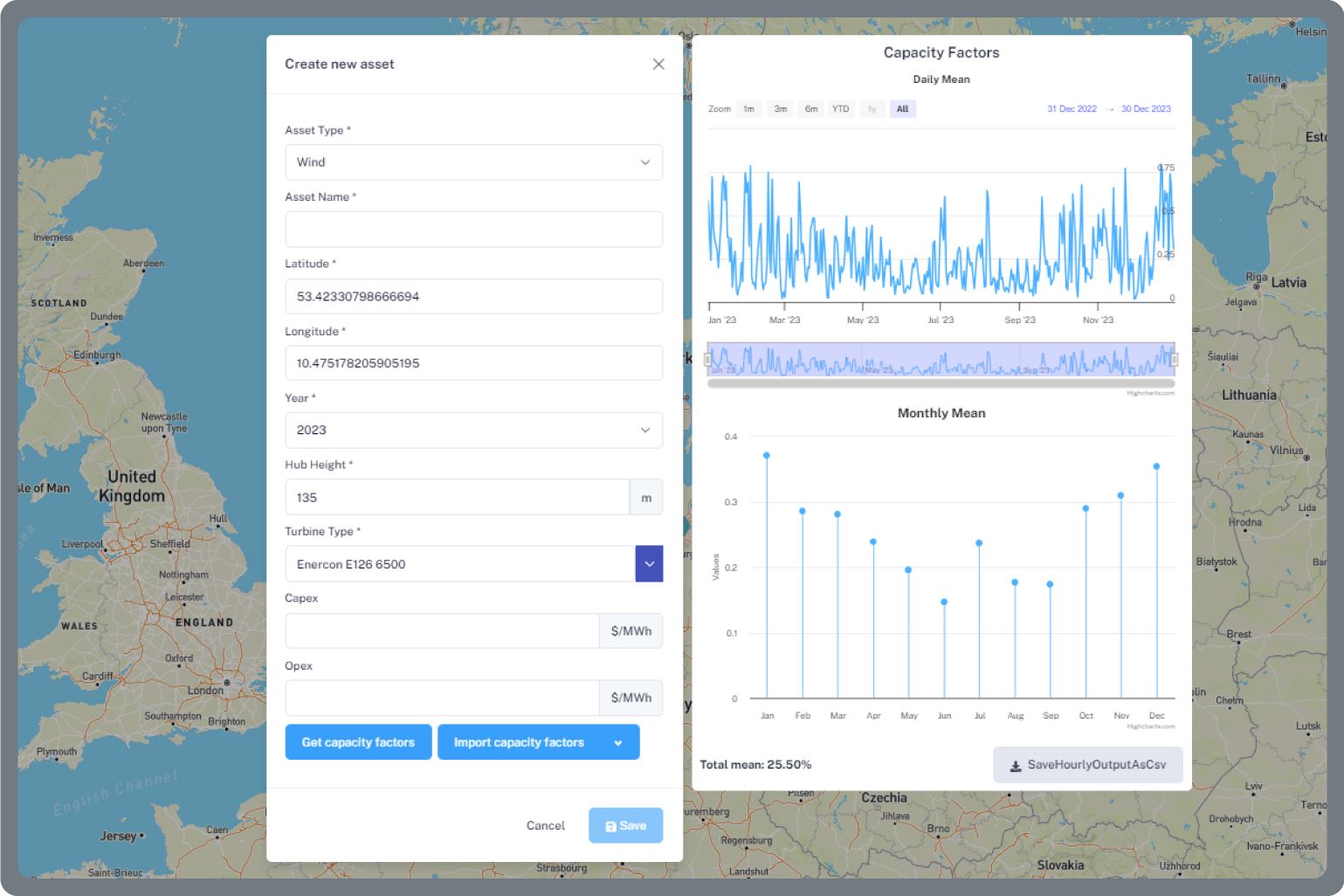

AI-Based Investment Analysis

Leverage AI to identify the most feasible battery investment options.

Uncertain cash flow predictions turn financial planning into guesswork, affecting long-term stability.

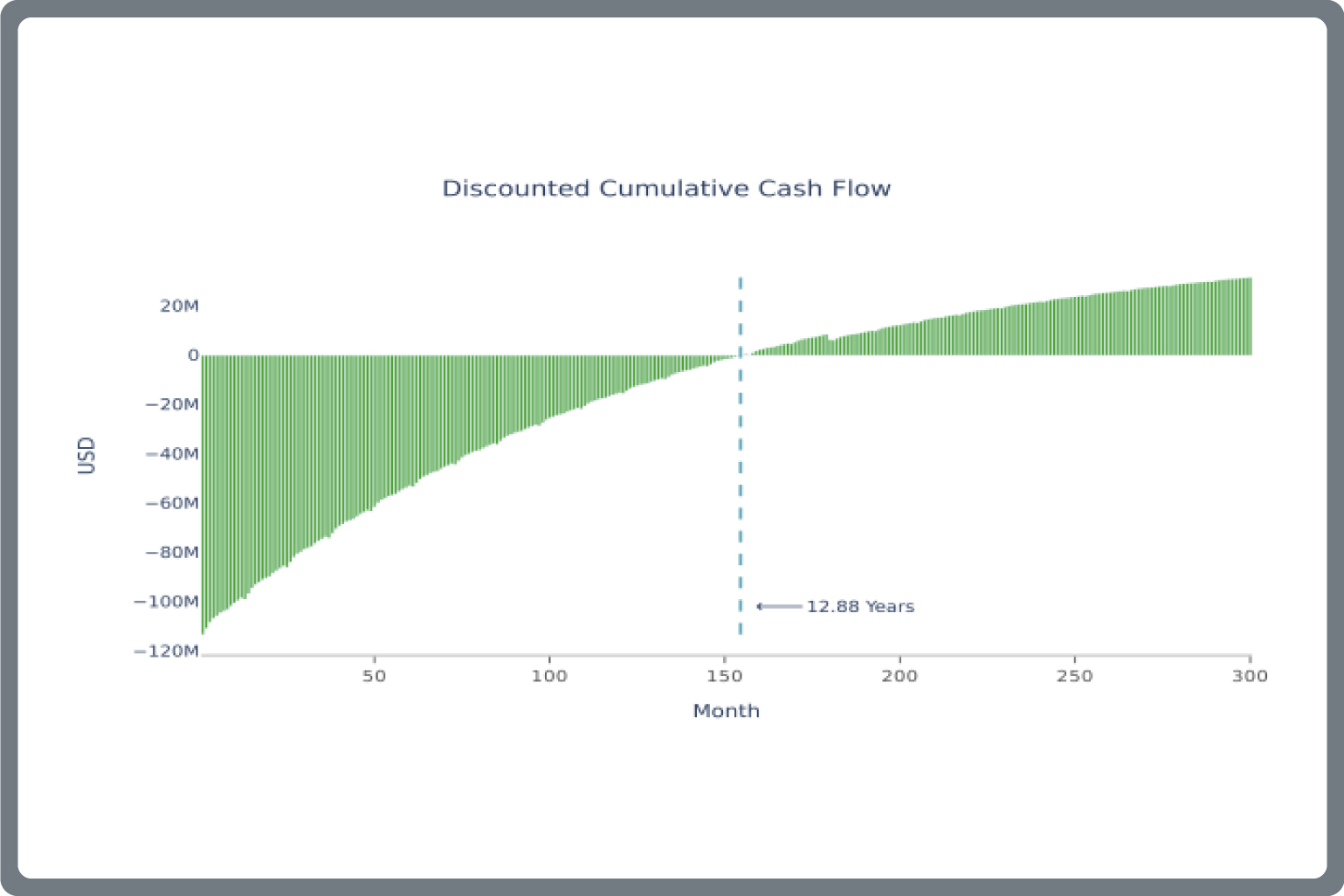

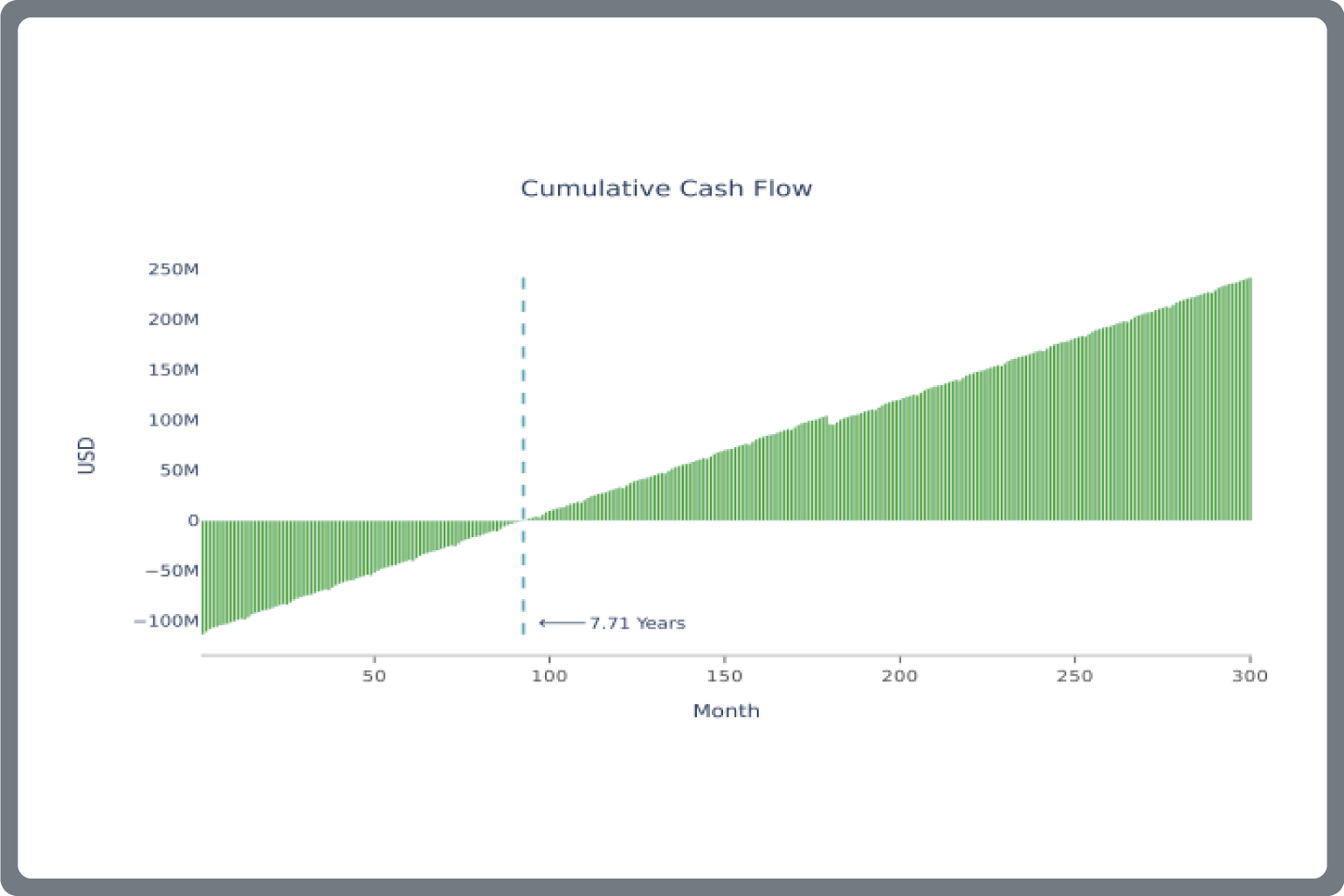

Automated Cash Flow

Provide clear, automated cash flow projections for better investment decisions.

Choosing the right technology is a complex feasibility issue that impacts project success.

Optimal Technology Choice

Assess and choose the best technology for optimal project success.

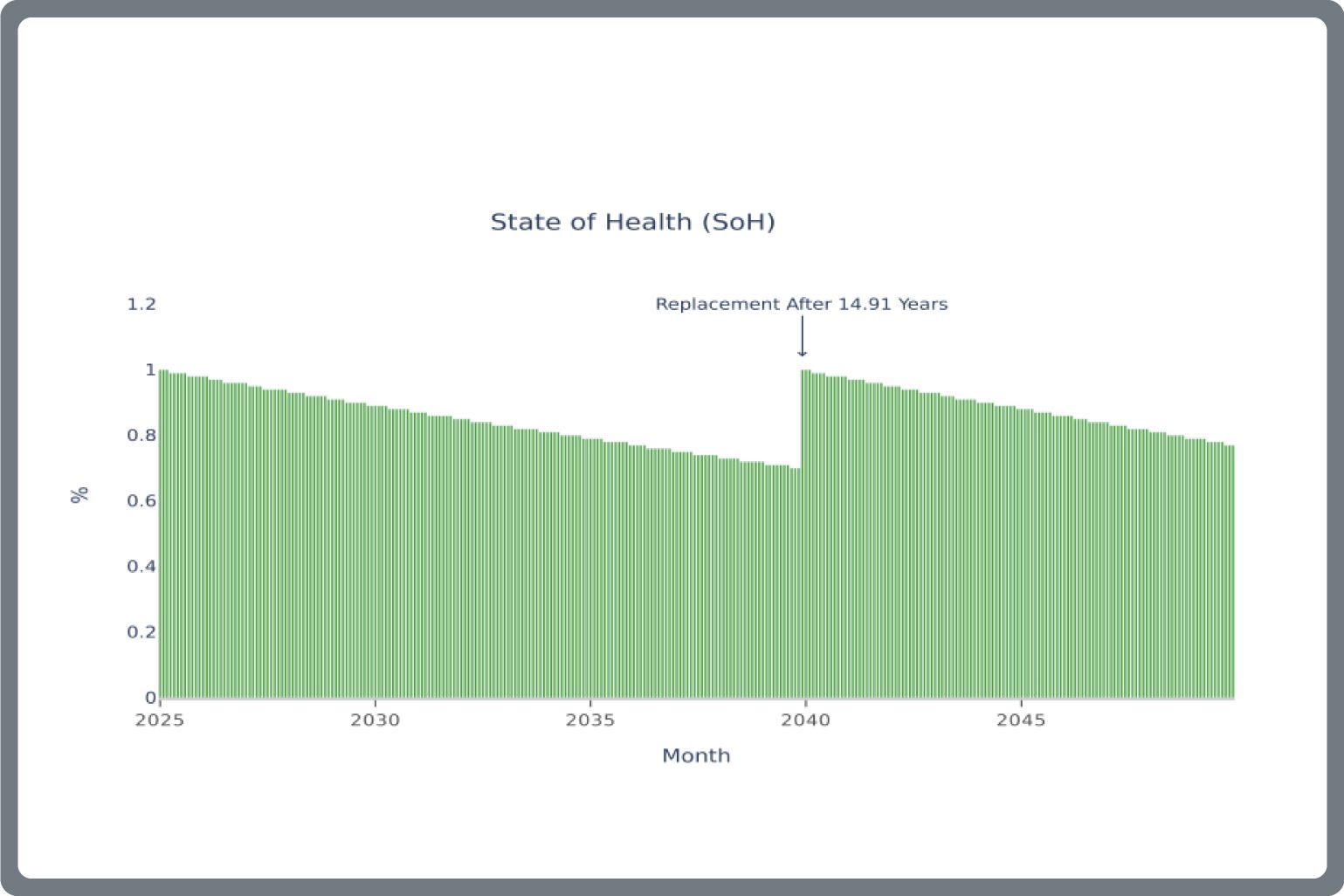

Battery life and replacement costs pose significant challenges in making feasible investment decisions.

Smart Battery Planning

Optimize battery replacement timing and costs with AI-driven insights.

Features

AI-powered insights for smarter investments and more feasible returns.

Related Products & Services

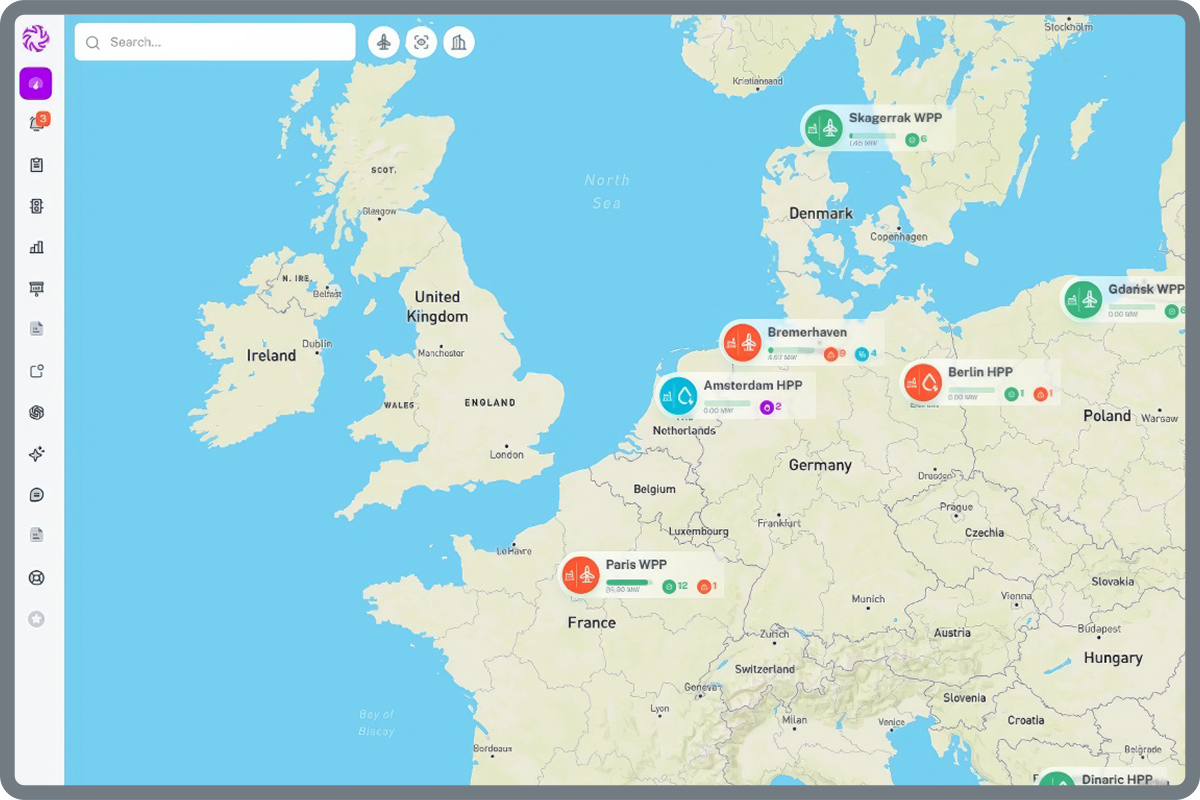

OnePact Monitor

Centralize and Optimize Your Operations

Integrating all energy production technologies into a single, interactive platform, by visualizing statuses, downtimes, and production metrics in real-time, streamlining monitoring and enhancing decision-making efficiency.

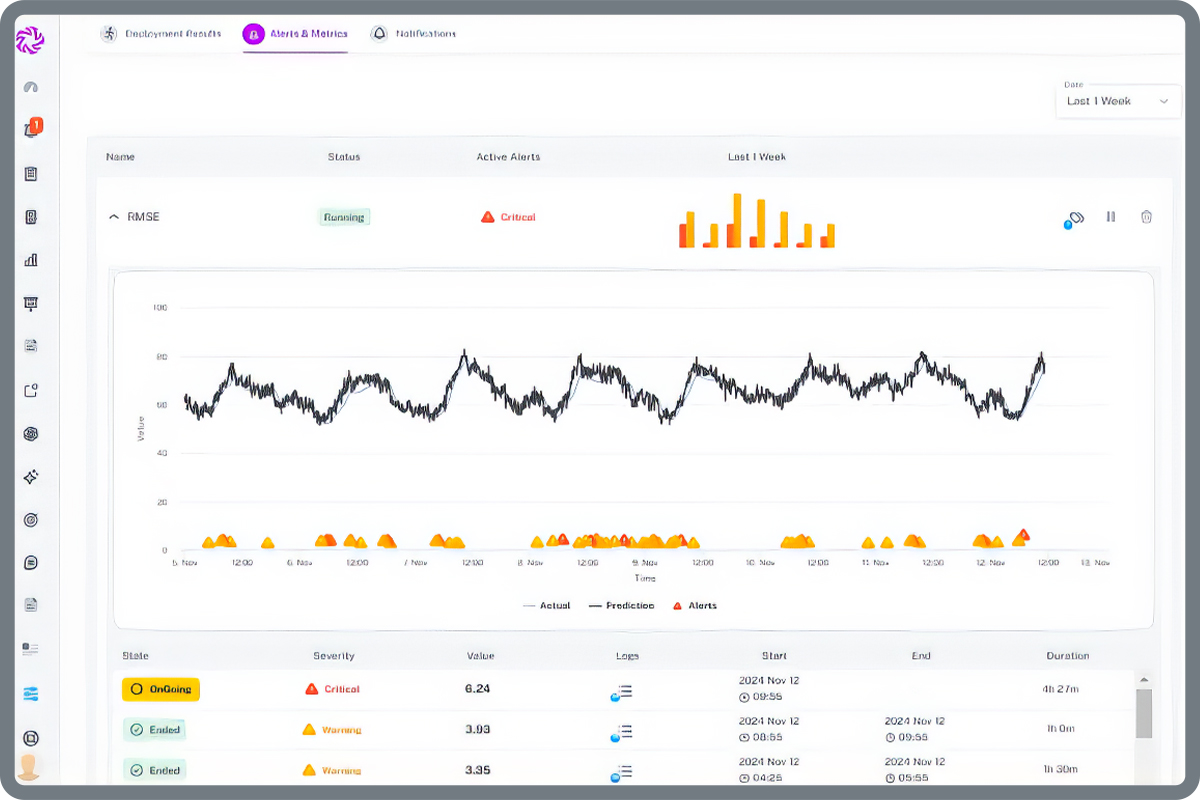

OnePact Predict

Maximizing Efficiency, by Minimizing Surprises

Minimizes unplanned downtime by using advanced predictive analytics to assess and optimize production assets. Proactively identifies potential failures, allowing for timely maintenance and improved operational performance.